It has been a long time before I updated my blogger! I was busy preparing for the finals and working as an intern, almost having no time writing this blogger.

Today I would like to present a back test on statistical arbitrage strategy with Cryptocurrency Futures.

Cryptocurrency is an emerging form of financial instrument, renowned as its safeness and decentralization. What's more, many investors build up exchanges to trade these digital assets. Some exchanges, for example, CME Group, OKCoin and BitMEX, even designed Futures Contract against these emerging assets.

These new derivatives are really interesting, not only because of their underlying assets are young and innovative, but also the way these futures are delivered at maturity time.

CME Group, one of the largest exchanges in the U.S. and in the world, for example, provide Bitcoin Futures settled and delivered in cash, which is U.S. Dollar. This instrument is great for hedge funds, because in that way they might be able to avoid the risks in holding the real form of digital assets.

However, for some other individual investors and Cryptocurrency funds, this might not be satisfying because they would like to hold only digital assets and only remit to U.S. Dollar, or any other currency they prefer to, when they deliver earnings to investors or paying out wages to managers.

Therefore, they prefer to Futures that settled and delivered in Cryptocurrency only. OKCoin, hence, offered BTC, ETH and many other Cryptocurrency that transacted via these currencies only. BitMEX, for example, provides only BTC as the only 'cash' in settlement and delivering of swaps, futures and other derivative contracts it provides.

In this article, we focus on the BTC, ETH, EOS, XRP and LTC futures against USDT (a Cryptocurrency that fixes its price against U.S. Dollar) listed in the OKCoin Exchange and see whether these futures have any arbitrage opportunities in the cross-time statistical arbitrage within these futures.

I. Data Source

Because of the idiosyncrasy of statistical arbitrage, we only focus on high-frequency data. We subtracted data from 12:00 to 23:59 in Jul 22, 2018 from OKEx (OKCoin) with its available public websocket API.

We divide the dataset into two parts: one for training model and the other for testing.

II. Principles

First, we select two trading assets from the available trading pairs, for example, BTC Futures this week (FT) against BTC Futures this quarter (FQ). With the data in training set, we build a single-variable linear model, with the slope coefficient as replicating ratio.

Second, we test the stationarity of the residuals in the first simple model. This is greatly important statistically and economically because stationarity suggests that the prices of the two futures are sharing a co-movement in their price. If not, the mean reversion might not eliminate.

For instance, in our dataset, we set y as the mid-price in ap1(the first level of ask price) and bid1 of BTC Futures matured this quarter, and model it against constant and mid-price of the Futures matured this week. The result is that ADF statistics is far less than 1% critical value, suggesting the residual is stationary, which means that it should converge to some constant.

mid_FQ ~ const + mid_FT

ADF Statistic: -4.358316

p-value: 0.000352

Critical Values:

1%: -3.430

5%: -2.862

10%: -2.567

Then, we develop a strategy to replicate the second Futures with the first one via the model we have built in the first step. The cross-time price movements should be linear, as suggested by literature because any violation against the pricing formula F = S*exp(r*T) would indicate arbitrage opportunity.

However, the above formula might not hold in reality because BTC can hardly be shorted, because it has high borrowing interest rate. But Generally we could build a substantially great linear model to replicate the second Futures with only the first Futures across maturity.

Finally, because we are sure that the discrepancy of one Futures asset against its replicated asset would converge to zero, we are aware that such arbitrage opportunity would decrease to zero. Therefore, it should be a great strategy to short the replicating portfolio when its price is relatively high, and long it when its price is somewhat lower.

III. Empirical Analysis

For example, suppose that y is BTC FQ(Futures matured this quarter) and x is BTC FT(Futures matured this week), and we have the model: y = a + b*x + e statistically.

Then, we compute the 5% and 95% percentile of the residual e: it suggests the deviation of a + b*x against its real price y. In our data sample, 95% percentile of e is about 6USD, and the 5% percentile about -6USD.

Our strategy is simple: short b shares of x and long 1 share of y when a + b*x - y = -e > 0, e < 0, or to be more stable, e less than the 5% percentile; long b shares of x and short 1 share of y when e exceeds the 95% percentile. This strategy should be obvious: short the spread of y - a - b*x when the residual is really large; and long the spread when otherwise.

Suggest that we only invest in 1 USD for the futures, and the performance in the testing period is shown in the following image:

It shows that without transaction cost, we can earn abnormal high profits, but the arbitrage opportunity disappears when taking transaction costs into account.

We have also tested ETH, EOS, XRP and LTC futures. As a result, most figures show the similar results. However, the PnL of XRP Futures statistical arbitrage strategy might be more volatile, as it has positive earnings even when transaction costs are taking into account.

This strategy has some shortcomings: it introduces only data for one day, which might be too small. Besides, it trains and tests with only one split and the testing part might need some more up-to-date formula. Some advanced techniques can also be considered.

In conclusion, the Futures market of Cryptocurrency-to-Cryptocurrency is somehow efficient. Maybe only the most clever and careful investors can be the successful arbitrager in this market.

Quantitative Investment Learning Together

Thursday, July 26, 2018

Saturday, March 24, 2018

Mind-Map for Junior Students Looking for Quantitative Research Positions

This roadmap is what I thought that should be beneficial for students like me who are interested in a quantitative research position in financial institutions, especially in hedge funds.

In my opinion, Finance, Mathematics, Statistics, Computer Science and Soft Skills are key elements to successfully looking for such a job. Sadly, the red blanks showed what I have not learnt yet, and not having basic knowledge in these fields might prevent me from having a competitive competence.

Hopefully, this graph could remind me of what is important for my career and what is not, and it should be much better if it could be beneficial for others who are also highly interested in quant research.

Image:

Friday, March 9, 2018

Black-Scholes Option Pricing Model and Empirical Analysis on 50ETF Option

In the previous blog, I tried Binomial-Tree Model to price 50ETF option in China, where I found it significantly underestimated the price. In the following analysis, I choose Black-Scholes Model instead, but found that although the difference of the predicted prices are significantly different with a p-value around 0.03, the results of prediction is pretty similar, leading to the same conclusion: Black-Scholes Model also underestimates the price of 50ETF option in China.

The formula of Black-Scholes is as follow:

I have also written the codes of estimating prices under BS Model:

from scipy import stats

def Black_Scholes(r,sig,S0,K,T,isCall):

# European Option Pricing

d1 = (np.log(S0/K) + (r+sig**2/2)*T)/(sig*np.sqrt(T))

d2 = d1 - sig*np.sqrt(T)

if isCall == True:

C0 = S0*stats.norm.cdf(d1,0,1)-np.exp(-r*T)*K*stats.norm.cdf(d2,0,1)

return C0, stats.norm.cdf(d1,0,1)

else:

P0 = -S0*stats.norm.cdf(-d1,0,1)+np.exp(-r*T)*K*stats.norm.cdf(-d2,0,1)

return P0, -stats.norm.cdf(-d1,0,1)

Keep all the other methods the same with the previous blog, only replace the function to price option under binomial-tree model with the function above, and increase the test period from the range of (2015-07-31, 2015-11-30) to (2015-07-31, 2016-03-22), the results of the prices are stored in this file: binomialResults_Binomial&BS.csv

Visualizing the difference between the two models, and we find that these two models nearly predict the same results:

plt.figure(dpi=200)

plt.title('Binomial Against Black-Scholes Price')

plt.xlabel('Binomial Price')

plt.ylabel('Black-Scholes Price')

plt.xlim(0,0.6); plt.ylim(0,0.6)

plt.plot(df_results.BinomialPrice,df_results.BSPrice,ls=' ',marker='.')

plt.savefig('Binomial Against Black-Scholes Price.png')

Although statistical analysis (t-test on the differences) shows that the results are significantly different with a p-value of around 0.03:

diff = df_results.BinomialPrice-df_results.BSPrice

ttest_1sample = stats.ttest_1samp(diff, 0)

In [1]: ttest_1sample

Out[1]: Ttest_1sampResult(statistic=2.1480372929383886, pvalue=0.031870221099299899)

Then we may conclude that although slightly different, Binomial-Tree and Black-Scholes Models predict nearly the same prices on 50ETF option from 2015-07-31 to 2016-03-22. Plot Black-Scholes Price against Real Price, and we can find it also significantly underestimates the price of options.

plt.figure(dpi=200)

plt.title('Black-Scholes Price against Real Price')

plt.xlabel('Black-Scholes Price')

plt.ylabel('Real Price')

plt.xlim(0,0.6); plt.ylim(0,0.6)

plt.plot(df_results.BinomialPrice,df_results.Close,ls=' ',marker='.')

plt.savefig('Black-Scholes Price against Real Price.png')

The formula of Black-Scholes is as follow:

I have also written the codes of estimating prices under BS Model:

from scipy import stats

def Black_Scholes(r,sig,S0,K,T,isCall):

# European Option Pricing

d1 = (np.log(S0/K) + (r+sig**2/2)*T)/(sig*np.sqrt(T))

d2 = d1 - sig*np.sqrt(T)

if isCall == True:

C0 = S0*stats.norm.cdf(d1,0,1)-np.exp(-r*T)*K*stats.norm.cdf(d2,0,1)

return C0, stats.norm.cdf(d1,0,1)

else:

P0 = -S0*stats.norm.cdf(-d1,0,1)+np.exp(-r*T)*K*stats.norm.cdf(-d2,0,1)

return P0, -stats.norm.cdf(-d1,0,1)

Keep all the other methods the same with the previous blog, only replace the function to price option under binomial-tree model with the function above, and increase the test period from the range of (2015-07-31, 2015-11-30) to (2015-07-31, 2016-03-22), the results of the prices are stored in this file: binomialResults_Binomial&BS.csv

Visualizing the difference between the two models, and we find that these two models nearly predict the same results:

plt.figure(dpi=200)

plt.title('Binomial Against Black-Scholes Price')

plt.xlabel('Binomial Price')

plt.ylabel('Black-Scholes Price')

plt.xlim(0,0.6); plt.ylim(0,0.6)

plt.plot(df_results.BinomialPrice,df_results.BSPrice,ls=' ',marker='.')

plt.savefig('Binomial Against Black-Scholes Price.png')

diff = df_results.BinomialPrice-df_results.BSPrice

ttest_1sample = stats.ttest_1samp(diff, 0)

Out[1]: Ttest_1sampResult(statistic=2.1480372929383886, pvalue=0.031870221099299899)

Then we may conclude that although slightly different, Binomial-Tree and Black-Scholes Models predict nearly the same prices on 50ETF option from 2015-07-31 to 2016-03-22. Plot Black-Scholes Price against Real Price, and we can find it also significantly underestimates the price of options.

plt.figure(dpi=200)

plt.title('Black-Scholes Price against Real Price')

plt.xlabel('Black-Scholes Price')

plt.ylabel('Real Price')

plt.xlim(0,0.6); plt.ylim(0,0.6)

plt.plot(df_results.BinomialPrice,df_results.Close,ls=' ',marker='.')

plt.savefig('Black-Scholes Price against Real Price.png')

Binomial-Tree Option Pricing Model and Empirical Analysis on 50ETF Option

I have implemented binomial-tree option pricing model to the only listed financial option in China: option on 50ETF. The results show that though somewhat similar, binomial-tree model cannot successfully price the options, and it might underestimate the risks which could lead to raising the prices.

I. Basic Steps on Binomial-Tree Model

Binomial-Tree Model assumes that in each time period, the stock price would either go up or go down, with a similar scale, as shown in the following graph:

import numpy as np

II. Empirical Analysis on 50ETF Option Data

50ETF (Managed by Huaxia Fund) is the only active tradable in-the-market financial asset who has derivative option. Its price basically reflects the future aspiration of overall financial market in China. Because the option on 50ETF is European, the following analysis would only consider European method.

I have collected the data of the basic information and daily price of underlying 50ETF prices (from Wind), and the data of information in the scale of tick of 50ETF option (private dataset). Because the dataset of option is too large, I might not put all of them online. I would only list one sample of the dataset here. Please e-mail me for further request. Other data are available here: Price of 50ETF, Basic Information about 50ETF Option, non-risk asset returns in China, description of the option dataset, one sample of the option dataset. The range of test time is from 2015-07-31 to 2015-11-30.

The price of 50ETF is like the price of the stock shown above, and mu is estimated by its historical returns from the estimated date to it was one year ago, dividing the time of each iteration. sigma is estimated by the standard variance with a similar method.

Codes of reading data, determining parameters, and pricing options for each option with respective strike price on each date with trading volumes greater than 0 are as follows:

import pandas as pd

import numpy as np

from matplotlib import pyplot as plt

import ffn

import datetime

import calendar

import os

# Read Basic Information of the Data

def filterMonth(kwd, files):

return [file for file in files if file.find(str(kwd)) != -1]

df_results = pd.DataFrame(columns=['TradingDate','SYMBOL','BinomialPrice','delta','Close'])

df_etf = pd.read_csv('50ETF.csv')

df_etf.index = pd.to_datetime(df_etf.TradingDate)

df_description = pd.read_excel('SHSOL1_description.xlsx')

df_basicinfo = pd.read_excel('Basic Information.xlsx')

df_basicinfo.index = df_basicinfo['期权代码'] #'期权代码' means the symbol of the option

df_nonrisk = pd.read_csv('nonrisk.csv')

df_nonrisk.index = pd.to_datetime(df_nonrisk.Clsdt)

for month in range(7,12):

monthRange = calendar.monthrange(year, month)

startdate = datetime.datetime(year,month,monthRange[0])

enddate = datetime.datetime(year,month,monthRange[1]) #One Month at most at one time

df_etf_inrange = df_etf[startdate:enddate]

ymonth = pd.to_datetime(startdate).year*100+pd.to_datetime(startdate).month

df_description = pd.read_excel('SHSOL1_description.xlsx')

cols = df_description['字段名'].tolist() #'字段名' means the name of the character

for (root, dirs, files) in os.walk('SHSOL1_TAQ1(1-100)'):

files = filterMonth(ymonth, files)

df = pd.DataFrame()

for f in files:

print(f)

if not df.empty:

df = pd.concat( [df,\

pd.read_csv('SHSOL1_TAQ1(1-100)\\'+f,names=cols)], axis=0 )

else:

df = pd.read_csv('SHSOL1_TAQ1(1-100)\\'+f,names=cols)

contracts = df.SYMBOL.unique()

df.index = pd.to_datetime(df.BUSINESSTIME)

# Load Parameters and Pricing

diags = []

for date in pd.date_range(startdate,enddate):

if date.to_pydatetime() in df_etf_inrange.index:

close = df_etf_inrange.Close[date.to_pydatetime()]

S0 = close

tradableOptions = df_basicinfo[(df_basicinfo['上市日'] <= date.to_pydatetime())&(df_basicinfo['到期日'] > date.to_pydatetime())] #'上市日' means the first date in the market; '到期日' means the last date, or strike/exercise date

returns = ffn.to_returns(df_etf.Close[pd.to_datetime(date)-datetime.timedelta(days=365):pd.to_datetime(date)-datetime.timedelta(days=1)])

mu0 = returns.mean()

sig0 = returns.std()

Ts = tradableOptions['到期日'] - date #'到期日' means strike/exercise date

Ks = tradableOptions['行权价'] #'行权价' means strike/exercise price

N = 20

r = df_nonrisk.Nrrdata[date.to_pydatetime()]/100

isCall = tradableOptions['认购/认沽'] == '认购' #'认购' means 'Call'; '认沽' means 'Put'

for option in tradableOptions.index:

if option not in contracts:

continue

reals = df[(df.SYMBOL==option)&(df.VOLUME!=0)]

if reals.empty:

continue

else:

reals = reals.LASTPRICE[date.strftime('%Y-%m-%d')]

if reals.empty:

continue

K = Ks[option]

T = Ts[option].days/365

isC = isCall[option]

real = reals[~np.isnan(reals)][-1]

mu = mu0/(T/N)

sig = sig0/np.sqrt(T/N)

binomial0, alpha0 = binomial_tree(r, mu, sig, S0, K, T, N, isC)

diags.append([date,option,binomial0,alpha0,real])

df_results = pd.concat([df_results,pd.DataFrame(diags,columns=['TradingDate','SYMBOL','BinomialPrice','delta','Close'])])

df_results.to_csv('binomialResults.csv')

The results of the 'TradingDate', 'SYMBOL', 'BinomialPrice', 'delta', and 'Close' are stored in 'binomialResults.csv'. Show the scatter plot of the binomial price and close price, we have:

plt.figure(dpi=200)

plt.title('Binomial Price against Real Price')

plt.xlabel('Binomial Price')

plt.ylabel('Real Price')

plt.xlim(0,0.6); plt.ylim(0,0.6)

plt.plot(df_results.BinomialPrice,df_results.Close,ls=' ',marker='.')

plt.savefig('Binomial Price against Real Price.png')

The plot shows that the price of binomial tree model is somewhat similar with the real price, but it seems that it is slightly smaller than the real price. We try the following codes to show the result of one sample t-test to show how similar the results are:

from scipy import stats

ttest_1sample = stats.ttest_1samp(df_results.BinomialPrice-df_results.Close, 0)

In[1]: ttest_1sample

Out[1]: Ttest_1sampResult(statistic=-22.871123481744913, pvalue=1.430363679347074e-91)

It shows that binomial-tree model significantly underestimate the option price. It seems that the risk in the option market cannot be successfully reflected in this model.

I. Basic Steps on Binomial-Tree Model

Binomial-Tree Model assumes that in each time period, the stock price would either go up or go down, with a similar scale, as shown in the following graph:

Assuming that we know the exact parameter of the growth and the variance, we can calculate the expected tree of stocks. Specify a certain dt up to its exercise date, we may get a stock tree.

After building the stock tree, we can derive the corresponding option tree. However, unlike calculating from the first node, in the Binomial-Tree Model, we calculate the price of the option from the end of the tree. That is, we calculate all the possible prices of option on the exercise date, and backwardly propagating the previous prices by the formula shown above, and leading to the estimated price at present.

We can also calculate the delta by (C(1,1)-C(1,0))/(S(1,1)-S(1,0)) to show the sensitivity of option to its underlying asset.

Similarly, replacing C(N,m) = Max(S(N,m)-K,0) with Max(K-S(N,m),0), we can derive the price at exercise date of the put option, and by remaining other steps the same, we might calculate the P(0,0) and its delta.

The Python codes of binomial tree are shown as following:

def binomial_tree(r,mu,sig,S0,K,T,N,isCall):

# European Option Pricing

dt = T/N

q=(np.exp(r*dt)-1-mu*dt)/(2*sig*np.sqrt(dt))+0.5;

U=1+mu*dt+sig*np.sqrt(dt)

D=1+mu*dt-sig*np.sqrt(dt)

DCF=np.exp(-r*dt)

S=np.zeros((N+1,N+1))

C=np.zeros((N+1,N+1))

S[0,0]=S0

for j in range(1,N+1):

S[0,j]=S[0,j-1]*D

for i in range(1,j+1):

S[i,j]=S[i-1,j-1]*U

if isCall == True:

for i in range(N+1):

C[i,N]=max(S[i,N]-K,0)

else:

for i in range(N+1):

C[i,N]=max(K-S[i,N],0)

for j in range(N-1,-1,-1):

for i in range(0,j+1):

C[i,j] = DCF*((1-q)*C[i,j+1]+q*C[i+1,j+1])

C0 = C[0,0]

alpha0 = (C[1,1]-C[0,1])/(S[1,1]-S[0,1])

return C0, alpha0

II. Empirical Analysis on 50ETF Option Data

50ETF (Managed by Huaxia Fund) is the only active tradable in-the-market financial asset who has derivative option. Its price basically reflects the future aspiration of overall financial market in China. Because the option on 50ETF is European, the following analysis would only consider European method.

I have collected the data of the basic information and daily price of underlying 50ETF prices (from Wind), and the data of information in the scale of tick of 50ETF option (private dataset). Because the dataset of option is too large, I might not put all of them online. I would only list one sample of the dataset here. Please e-mail me for further request. Other data are available here: Price of 50ETF, Basic Information about 50ETF Option, non-risk asset returns in China, description of the option dataset, one sample of the option dataset. The range of test time is from 2015-07-31 to 2015-11-30.

The price of 50ETF is like the price of the stock shown above, and mu is estimated by its historical returns from the estimated date to it was one year ago, dividing the time of each iteration. sigma is estimated by the standard variance with a similar method.

Codes of reading data, determining parameters, and pricing options for each option with respective strike price on each date with trading volumes greater than 0 are as follows:

import pandas as pd

import numpy as np

from matplotlib import pyplot as plt

import ffn

import datetime

import calendar

import os

# Read Basic Information of the Data

def filterMonth(kwd, files):

return [file for file in files if file.find(str(kwd)) != -1]

df_results = pd.DataFrame(columns=['TradingDate','SYMBOL','BinomialPrice','delta','Close'])

df_etf = pd.read_csv('50ETF.csv')

df_etf.index = pd.to_datetime(df_etf.TradingDate)

df_description = pd.read_excel('SHSOL1_description.xlsx')

df_basicinfo = pd.read_excel('Basic Information.xlsx')

df_basicinfo.index = df_basicinfo['期权代码'] #'期权代码' means the symbol of the option

df_nonrisk = pd.read_csv('nonrisk.csv')

df_nonrisk.index = pd.to_datetime(df_nonrisk.Clsdt)

# Load the price of option

year = 2015for month in range(7,12):

monthRange = calendar.monthrange(year, month)

startdate = datetime.datetime(year,month,monthRange[0])

enddate = datetime.datetime(year,month,monthRange[1]) #One Month at most at one time

df_etf_inrange = df_etf[startdate:enddate]

ymonth = pd.to_datetime(startdate).year*100+pd.to_datetime(startdate).month

df_description = pd.read_excel('SHSOL1_description.xlsx')

cols = df_description['字段名'].tolist() #'字段名' means the name of the character

for (root, dirs, files) in os.walk('SHSOL1_TAQ1(1-100)'):

files = filterMonth(ymonth, files)

df = pd.DataFrame()

for f in files:

print(f)

if not df.empty:

df = pd.concat( [df,\

pd.read_csv('SHSOL1_TAQ1(1-100)\\'+f,names=cols)], axis=0 )

else:

df = pd.read_csv('SHSOL1_TAQ1(1-100)\\'+f,names=cols)

contracts = df.SYMBOL.unique()

df.index = pd.to_datetime(df.BUSINESSTIME)

# Load Parameters and Pricing

diags = []

for date in pd.date_range(startdate,enddate):

if date.to_pydatetime() in df_etf_inrange.index:

close = df_etf_inrange.Close[date.to_pydatetime()]

S0 = close

tradableOptions = df_basicinfo[(df_basicinfo['上市日'] <= date.to_pydatetime())&(df_basicinfo['到期日'] > date.to_pydatetime())] #'上市日' means the first date in the market; '到期日' means the last date, or strike/exercise date

returns = ffn.to_returns(df_etf.Close[pd.to_datetime(date)-datetime.timedelta(days=365):pd.to_datetime(date)-datetime.timedelta(days=1)])

mu0 = returns.mean()

sig0 = returns.std()

Ts = tradableOptions['到期日'] - date #'到期日' means strike/exercise date

Ks = tradableOptions['行权价'] #'行权价' means strike/exercise price

N = 20

r = df_nonrisk.Nrrdata[date.to_pydatetime()]/100

isCall = tradableOptions['认购/认沽'] == '认购' #'认购' means 'Call'; '认沽' means 'Put'

for option in tradableOptions.index:

if option not in contracts:

continue

reals = df[(df.SYMBOL==option)&(df.VOLUME!=0)]

if reals.empty:

continue

else:

reals = reals.LASTPRICE[date.strftime('%Y-%m-%d')]

if reals.empty:

continue

K = Ks[option]

T = Ts[option].days/365

isC = isCall[option]

real = reals[~np.isnan(reals)][-1]

mu = mu0/(T/N)

sig = sig0/np.sqrt(T/N)

binomial0, alpha0 = binomial_tree(r, mu, sig, S0, K, T, N, isC)

diags.append([date,option,binomial0,alpha0,real])

df_results = pd.concat([df_results,pd.DataFrame(diags,columns=['TradingDate','SYMBOL','BinomialPrice','delta','Close'])])

df_results.to_csv('binomialResults.csv')

The results of the 'TradingDate', 'SYMBOL', 'BinomialPrice', 'delta', and 'Close' are stored in 'binomialResults.csv'. Show the scatter plot of the binomial price and close price, we have:

plt.figure(dpi=200)

plt.title('Binomial Price against Real Price')

plt.xlabel('Binomial Price')

plt.ylabel('Real Price')

plt.xlim(0,0.6); plt.ylim(0,0.6)

plt.plot(df_results.BinomialPrice,df_results.Close,ls=' ',marker='.')

plt.savefig('Binomial Price against Real Price.png')

The plot shows that the price of binomial tree model is somewhat similar with the real price, but it seems that it is slightly smaller than the real price. We try the following codes to show the result of one sample t-test to show how similar the results are:

from scipy import stats

ttest_1sample = stats.ttest_1samp(df_results.BinomialPrice-df_results.Close, 0)

In[1]: ttest_1sample

Out[1]: Ttest_1sampResult(statistic=-22.871123481744913, pvalue=1.430363679347074e-91)

It shows that binomial-tree model significantly underestimate the option price. It seems that the risk in the option market cannot be successfully reflected in this model.

Thursday, March 8, 2018

Logistic Regression: Classical Binomial Linear Classification Machine Learning Algorithm

Logistic Regression is one of the most basic machine learning classification algorithms. It is fast and easy to understand, but it could only identify binomial classes. Other than that, we may need Softmax Regression or Factorization Machine, which are more generalized forms of Logistic Regression aiming to solve multi-classes problems. Furthermore, emerging usage of SVM, ANN, and Decision Tree can also be highly powerful.

However, in this blog, I am only going to focus on Logistic Regression, briefly summarize the essential steps of it, and give a simple example. The dataset is available here and it was extracted from https://catalog.data.gov/dataset/state-energy-data-system-seds-complete-dataset-through-2009#sec-dates.

I. Introduction to Dataset

The dataset is about the energy profile of all states of U.S. from 1960 to 2009. The meanings of each attribute is available in the metadata posted in the website. The 'energy.csv' is exactly the same but preprocessed to panel form.

Suppose we would like to teach our computers to distinguish the economic and energy developing status of different states, and to make it solvable by Logistic Regression, we only recognize two states, Hawaii ('HI') and New York ('NY'). To make the results visualizable, we only include two attributes as the explainers, and they are Total Energy Average Consumption ('TETCB'/Billion Btu) and Real Value of GDP ('GDPRV'/Million Dollars).

Firstly, we could have a brief look at the scatter plots of the two states with the following codes:

import numpy as np

import pandas as pd

from matplotlib import pyplot as plt

df = pd.read_csv('energy_data.csv')

df1 = df[['StateCode','Year','GDPRV','TETCB']].dropna()

state1 = 'HI'

state2 = 'NY'

fullset = df1[(df1['StateCode'] == state1)|(df1['StateCode'] ==state2)]

plt.figure(dpi=150)

plt.title(state1+' & '+state2)

plt.xlabel('Total Energy Total Consumption (Billion Btu)')

plt.ylabel('Real GDP Value (Million Dollars)')

plt.plot(fullset[fullset.StateCode==state1].TETCB,fullset[fullset.StateCode==state1].GDPRV,ls='',marker='.',color='blue')

plt.plot(fullset[fullset.StateCode==state2].TETCB,fullset[fullset.StateCode==state2].GDPRV,ls='',marker='.',color='red')

plt.legend([state1,state2])

plt.savefig(state1+'_'+state2+'_scatter.png')

Logistic Regression uses sigmoid function as the function to transfer processed attributes to probability and in the meanwhile beautifully lead the loss function to be convex, and implement maximum likelihood estimation to minimize the loss function of the estimations and real values.

Instead of looking for analytical solutions, we specify a random initial hyperplane and use gradient descent method to learn how close the hyperplane is to the final optima. As thousands of iteration, our results might steadily converge to a constant, which should be the final result of the weights, matrix form of classification hyperplane.

The following codes describe the steps and the codes:

def sig(x):

return 1.0 / (1 + np.exp(-x))

def lr_train_bgd(feature, label, maxCycle, alpha):

n = np.shape(feature)[1]

w = np.mat(np.random.rand(n,1))

i = 0

while i <= maxCycle:

i += 1

h = sig(feature * w)

err = label - h

if i % (maxCycle/10) == 0:

print("\t---------iter=" + str(i) + \

" , sum of err= " + str(np.sum(np.abs(err))))

print('\t-------------weights=',end=' ')

print(w)

w = w + alpha * feature.T * err

return w

#The codes of the function sig(*) and lr_train_bgd(*) is available in https://github.com/zhaozhiyong19890102/Python-Machine-Learning-Algorithm/blob/master/Chapter_1%20Logistic%20Regression/lr_test.py

ones = np.ones((len(fullset),1))

feature = np.column_stack((ones,np.mat(fullset[['TETCB','GDPRV']])))

label = []

for s in fullset.StateCode:

if s == state1:

label.append(0.0)

elif s == state2:

label.append(1.0)

label = np.mat(label).T

weights = lr_train_bgd(feature,label,10000,0.1)

plt.figure(dpi=150)

plt.title(state1+' & '+state2+' without Standardization')

plt.xlabel('Total Energy Total Consumption (Billion Btu)')

plt.ylabel('Real GDP Value (Million Dollars)')

plt.plot(fullset[fullset.StateCode==state1].TETCB,fullset[fullset.StateCode==state1].GDPRV,ls='',marker='.',color='blue')

plt.plot(fullset[fullset.StateCode==state2].TETCB,fullset[fullset.StateCode==state2].GDPRV,ls='',marker='.',color='red')

x = np.linspace(200000,700000)

y = (- weights[0]/weights[2] - weights[1]*x/weights[2]).T

plt.plot(x,y)

plt.legend([state1,state2])

plt.savefig(state1+'_'+state2+'_LogisticRegression_noStandard.png')

I have also tried a simple test without standardizing attributes (but the attributes are relatively in the same scale), and I may provide all the codes.

Part I: Introduction to dataset

Part II: Logistic Regression without Standardization

Part III: Logistic Regression with Manual Dataset

Part IV: Logistic Regression with Standardization

Reference:

Machine Learning Algorithm: Python, Zhiyong ZHAO (《Python机器学习算法》赵志勇);essential codes are from his github website referred previously.

However, in this blog, I am only going to focus on Logistic Regression, briefly summarize the essential steps of it, and give a simple example. The dataset is available here and it was extracted from https://catalog.data.gov/dataset/state-energy-data-system-seds-complete-dataset-through-2009#sec-dates.

I. Introduction to Dataset

The dataset is about the energy profile of all states of U.S. from 1960 to 2009. The meanings of each attribute is available in the metadata posted in the website. The 'energy.csv' is exactly the same but preprocessed to panel form.

Suppose we would like to teach our computers to distinguish the economic and energy developing status of different states, and to make it solvable by Logistic Regression, we only recognize two states, Hawaii ('HI') and New York ('NY'). To make the results visualizable, we only include two attributes as the explainers, and they are Total Energy Average Consumption ('TETCB'/Billion Btu) and Real Value of GDP ('GDPRV'/Million Dollars).

Firstly, we could have a brief look at the scatter plots of the two states with the following codes:

import numpy as np

import pandas as pd

from matplotlib import pyplot as plt

df = pd.read_csv('energy_data.csv')

df1 = df[['StateCode','Year','GDPRV','TETCB']].dropna()

state1 = 'HI'

state2 = 'NY'

fullset = df1[(df1['StateCode'] == state1)|(df1['StateCode'] ==state2)]

plt.figure(dpi=150)

plt.title(state1+' & '+state2)

plt.xlabel('Total Energy Total Consumption (Billion Btu)')

plt.ylabel('Real GDP Value (Million Dollars)')

plt.plot(fullset[fullset.StateCode==state1].TETCB,fullset[fullset.StateCode==state1].GDPRV,ls='',marker='.',color='blue')

plt.plot(fullset[fullset.StateCode==state2].TETCB,fullset[fullset.StateCode==state2].GDPRV,ls='',marker='.',color='red')

plt.legend([state1,state2])

plt.savefig(state1+'_'+state2+'_scatter.png')

Because our analysis is simplified, we could easily observe the difference between the two plots. For example, we could easily classify a point (600000, 40000) to 'NY'. Now, we can test the ability of machine learning algorithm.

II. Steps and Codes

Logistic Regression uses sigmoid function as the function to transfer processed attributes to probability and in the meanwhile beautifully lead the loss function to be convex, and implement maximum likelihood estimation to minimize the loss function of the estimations and real values.

Instead of looking for analytical solutions, we specify a random initial hyperplane and use gradient descent method to learn how close the hyperplane is to the final optima. As thousands of iteration, our results might steadily converge to a constant, which should be the final result of the weights, matrix form of classification hyperplane.

The following codes describe the steps and the codes:

return 1.0 / (1 + np.exp(-x))

def lr_train_bgd(feature, label, maxCycle, alpha):

n = np.shape(feature)[1]

w = np.mat(np.random.rand(n,1))

i = 0

while i <= maxCycle:

i += 1

h = sig(feature * w)

err = label - h

if i % (maxCycle/10) == 0:

print("\t---------iter=" + str(i) + \

" , sum of err= " + str(np.sum(np.abs(err))))

print('\t-------------weights=',end=' ')

print(w)

w = w + alpha * feature.T * err

return w

#The codes of the function sig(*) and lr_train_bgd(*) is available in https://github.com/zhaozhiyong19890102/Python-Machine-Learning-Algorithm/blob/master/Chapter_1%20Logistic%20Regression/lr_test.py

ones = np.ones((len(fullset),1))

feature = np.column_stack((ones,np.mat(fullset[['TETCB','GDPRV']])))

label = []

for s in fullset.StateCode:

if s == state1:

label.append(0.0)

elif s == state2:

label.append(1.0)

label = np.mat(label).T

weights = lr_train_bgd(feature,label,10000,0.1)

plt.figure(dpi=150)

plt.title(state1+' & '+state2+' without Standardization')

plt.xlabel('Total Energy Total Consumption (Billion Btu)')

plt.ylabel('Real GDP Value (Million Dollars)')

plt.plot(fullset[fullset.StateCode==state1].TETCB,fullset[fullset.StateCode==state1].GDPRV,ls='',marker='.',color='blue')

plt.plot(fullset[fullset.StateCode==state2].TETCB,fullset[fullset.StateCode==state2].GDPRV,ls='',marker='.',color='red')

x = np.linspace(200000,700000)

y = (- weights[0]/weights[2] - weights[1]*x/weights[2]).T

plt.plot(x,y)

plt.legend([state1,state2])

plt.savefig(state1+'_'+state2+'_LogisticRegression_noStandard.png')

The solid line in the plot is the classification line. Above it is classified as 'HI' and beneath it as 'HI'. Obviously, the result is not satisfactory. I asked codes from my friend professional at computer science and found nearly the same results. It turned out that I was once so upset that this algorithm was too unreliable.

III. The importance of Standardizing Attributes

However, I suddenly got an idea: I forgot to standardize my explainers / attributes! Because Logistic Regression uses gradient descent method to improve the accuracy of classification hyperplane, and without standardizing my attributes to the same scale, my loss function might be a extremely extended ellipsoid, and any specified learning rate might be either too large to converge the loss function or too small to speed up the calculations.

Change a little bit of the code, by adding the red part inside the codes:

......

state1 = 'NY'

state2 = 'HI'

fullset = df1[(df1['StateCode'] == state1)|(df1['StateCode'] ==state2)]

for col in ('GDPRV','TETCB'):

fullset[col] = (fullset[col] - np.min(fullset[col]))/(np.max(fullset[col]) - np.min(fullset[col]))

def sig(x):

return 1.0 / (1 + np.exp(-x))

.......

return 1.0 / (1 + np.exp(-x))

.......

We may get a satisfactory result of classification:

Therefore, we could use this code to solve binomial classification problems.

IV. Available Source Codes

I have also tried a simple test without standardizing attributes (but the attributes are relatively in the same scale), and I may provide all the codes.

Part I: Introduction to dataset

Part II: Logistic Regression without Standardization

Part III: Logistic Regression with Manual Dataset

Part IV: Logistic Regression with Standardization

Reference:

Machine Learning Algorithm: Python, Zhiyong ZHAO (《Python机器学习算法》赵志勇);essential codes are from his github website referred previously.

Saturday, February 24, 2018

BackTest on ARIMA Forecast in Python

ARIMA is one of the most essential time-series-estimation methods. In this article, I am going through its basic and crucial elements, including tests of stationary and white noise before ARIMA modeling and predicting.

The results only include estimation of price, and backtest results like Sharpe are not calculated.

Firstly, we are doing some data preprocessing. The data 'SH50 Price.csv' includes the price information of the 50 listed in Shanghai Stock Exchange, components of SSE50 index, from 2009 to 2013. Data is available here.

# Data Preprocessing

import math

import pandas as pd

import numpy as np

from matplotlib import pyplot as plt

import ffn

df = pd.read_csv('SH50 Price.csv')

df.Date = pd.to_datetime(df.Date)

stocks = df.columns[1:].tolist()

prices = df[stocks]

prices.index = df.Date

simret = ffn.to_returns(df[stocks])

simret.index = df.Date

p_stk = prices['Stk_600000'][1:]

r_stk = simret['Stk_600000'][1:]

After preprocessing, we obtain price series 'p_stk' and returns series 'r_stk'. Then, we are going to have a glance at the information provided in the datasets. We choose stk 600000 as our target to research and forecast.

# Part I: Print figures

plt.figure(dpi=200)

plt.plot(p_stk)

plt.title('Price of Stk 600000')

plt.savefig('Price of Stk 600000.png')

plt.figure(dpi=200)

plt.plot(r_stk)

plt.title('Returns of Stk 600000')

plt.savefig('Returns of Stk 600000.png')

The plots are:

Because ARIMA requires that the time series should be stationary and not white noise, in the following two parts, we are using ADF Unitroot Test and Ljung-Box White Noise Test to evaluate the characteristics of the price and returns series.

# Part II: Test Stationary: ADF unitroot test

from arch.unitroot import ADF

adf = ADF(p_stk)

print(adf.summary()) #p-value: 0.042

adf = ADF(r_stk)

print(adf.summary()) #p-value: 0.000

Both of them are stationary, while returns series are more stationary as it has significantly smaller p-value, even though the p-value of prices are lower than 5%.

# Part III: Test White Noise: Ljung-Box test

from statsmodels.tsa import stattools

LjungBox_p = stattools.q_stat(stattools.acf(p_stk)[1:12],len(p_stk))

LjungBox_r = stattools.q_stat(stattools.acf(r_stk)[1:12],len(r_stk))

>> LjungBox_p

(array([ 1186.72403401, 2347.64336586, 3480.90920079, 4585.93740601,

5664.13867134, 6714.87739681, 7742.00626975, 8745.83186807,

9727.36536476, 10686.98822401, 11624.15953127, 12540.96124026,

13436.9868527 , 14312.56022102, 15168.03444284, 16003.30196641,

16817.86975455, 17612.10904286, 18385.5534396 , 19138.93560575,

19870.54594297, 20580.38199531, 21268.22774876]),

array([ 4.68328128e-260, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000]))

>> LjungBox_r

(array([ 5.74442324e-05, 6.94963524e-01, 2.36008649e+00,

2.56248994e+00, 3.34789797e+00, 8.93787714e+00,

9.12876556e+00, 9.22065050e+00, 9.59020002e+00,

9.72752825e+00, 1.23203023e+01, 1.34820767e+01,

1.38328148e+01, 1.41616503e+01, 1.41655260e+01,

1.61315152e+01, 1.61315159e+01, 1.76274610e+01,

1.78485936e+01, 2.20053144e+01, 2.20102166e+01,

2.20334465e+01, 2.20547776e+01]),

array([ 0.99395273, 0.7064649 , 0.50110775, 0.63348204, 0.64651689,

0.17710208, 0.24354298, 0.32402559, 0.38466708, 0.46471465,

0.340055 , 0.3349957 , 0.38572255, 0.43773873, 0.51301413,

0.44382027, 0.51453146, 0.48043601, 0.5325723 , 0.34022234,

0.39892134, 0.45789384, 0.5169469 ]))

The null hypothesis is the series is white noise, and when the p-values (lower part of the result) of corresponding scores (upper part) are very small, we would reject the null hypothesis. In the prices, all values are highly significant, while the returns cannot reject the hypothesis (with 24 lags, the lowest one is even more then 10%).

Therefore, we accept that returns series are white noise, and we would only use price series in the following analysis.

# Part IV: Determine the order p and q in ARMA(p,q)

In part IV, we will use ARMA instead of ARIMA because we have already determined that order of I, d = 0 because returns are white noise. Next, we will determine the orders of ARMA(p,q).

Our first method to determine orders:

Draw ACF and PACF, and we found that ACF decays slowly while PACF suddenly drops, indicating an AR process only. We calculate its corresponding AIC and fit them with AR, setting maximum number of lags to be 12, and get the result that 1 is great. Check again with PACF plot, only lag 1 has significant coefficient. Therefore, we determine it to be AR(1) process.

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

axe1 = plt.subplot(211)

axe2 = plt.subplot(212)

plot1 = plot_acf(p_stk,lags=24,ax=axe1)

plot2 = plot_pacf(p_stk,lags=24,ax=axe2)

# Clear trend of AR only, with order for MA q = 0

# According to PACF, order p = 1

from statsmodels.tsa import ar_model

print(ar_model.AR(p_stk).select_order(maxlag=12,ic='aic')) # 1

Our alternative method to determine orders: Calculate the information criteria values of each order pairs.

order_determine = stattools.arma_order_select_ic(p_stk,ic=['bic','aic'])

>>order_determine

{'aic': 0 1 2

0 9463.164218 8000.817909 7042.006694

1 4518.521655 4520.130771 4520.321662

2 4520.100423 4520.516399 4521.249129

3 4520.254865 4521.373563 NaN

4 4520.303277 4520.282986 4517.939588,

'aic_min_order': (4, 2),

'bic': 0 1 2

0 9473.360970 8016.113036 7062.400197

1 4533.816782 4540.524274 4545.813540

2 4540.493925 4546.008277 4551.839383

3 4545.746743 4551.963817 NaN

4 4550.893531 4555.971616 4558.726593,

'bic_min_order': (1, 0)}

As BIC is more robust, the AIC of (1,0) is enarly the same with (4,2), and lower orders are better models to avoid overfitting risk, we choose ARMA(1,0), which leads to the same results with the above method.

# Part V: Fit prices with ARIMA(1,0,0) (Also ARMA(1,0) or AR(1))

# from statsmodels.tsa import ar_model

model = ar_model.AR(p_stk).fit(maxlag=12,method='cmle',ic='aic')

# arima_model package is a similar package, leading to a same result

from statsmodels.tsa import arima_model

model2 = arima_model.ARIMA(p_stk,order=(1,0,0)).fit()

Even though 'model' is the same with 'model2', the package ar_model has some bugs as I test it, and the package arima_model has attribute 'forecast' and it is more convenient to use this one. So, we only use model2 in the following parts.

>>model2.summary()

After ARMA modeling, we need to test whether the results of ARMA is white noise. If not, we may need more thorough researches. Fortunately, the results in the following shows that our result is white noise and no auto-correlation patterns.

# Part VI: Robustness Check: Test on Residuals

res = model2.resid

stdres = res/math.sqrt(model2.sigma2)

plt.figure(dpi=200)

ax1 = plt.subplot(211)

ax2 = plt.subplot(212)

ax1.set_title('standard residuals')

ax1.plot(stdres)

plot_acf(stdres,lags=24,ax=ax2)

plt.savefig('test_on_residuals_of_ARMA.png')

# Ljung-Box White Noise tests:

LjungBox_m = stattools.q_stat(stattools.acf(stdres[1:])[1:24],len(stdres[1:]))

# Residuals are White Noises

>>LjungBox_m

(array([ 0.27569431, 1.76892747, 3.40736876, 4.00228122,

4.30689222, 8.74894778, 8.75161177, 8.79754988,

8.84251288, 9.8780216 , 12.49860582, 13.03671273,

13.05266838, 13.31819495, 13.83520634, 16.51855888,

16.83245856, 18.33579538, 18.40466682, 23.02723339,

23.05146308, 23.051464 , 23.17217018]),

array([ 0.59953731, 0.41293556, 0.33297629, 0.40569721, 0.50612843,

0.18819711, 0.27098469, 0.35966135, 0.45193696, 0.45125936,

0.32735392, 0.3663779 , 0.44375169, 0.50163586, 0.53806246,

0.41739165, 0.46577191, 0.43374623, 0.49557738, 0.2874593 ,

0.34124064, 0.39882846, 0.45075531]))

To conclude, we cannot reject that results white noise, and the ARMA models can be used to forecast.

In the next part, we are going to give a forward forecast on the results, and plot corresponding confidence intervals.

# Part VII: Forecast

forecast = model2.forecast(steps=15)

plt.figure(dpi=200)

plt.grid(True)

plt.xticks(rotation=15)

plt.title('ARIMA(1,0,0) Forecast for Stk 600000')

plt.plot(p_stk[-30:])

dates = pd.DatetimeIndex(freq='d',start='2014-01-01',end='2014-01-15')

plt.plot(dates,forecast[0])

plt.plot(dates,forecast[2][:,0],ls=':')

plt.plot(dates,forecast[2][:,1],ls=':')

plt.legend(['real','pred','lc','uc'])

plt.savefig('ARIMA_forecast.png')

Finally, we perform out-of-sample test of ARIMA(1,0,0) by estimating one-day-forward price in each day of the sets with models built by the previous data. Continue the test every day beginning in the 100th index, and calculate the results. Because of limited space, we only provide a plot including the last 110 sets of predicted price against real price.

# Part VIII: Out-of-Sample Test for ARIMA(1,0,0) Performance

preds = []; lcs = []; ucs = []

for i in range(100,len(p_stk)):

model_o = arima_model.ARIMA(p_stk[:i],order=(1,0,0)).fit()

preds.append(model_o.forecast(1)[0][0])

lcs.append(model_o.forecast(1)[2][0][0])

ucs.append(model_o.forecast(1)[2][0][1])

plt.figure(dpi=200)

plt.grid(True)

plt.xticks(rotation=15)

plt.title('Real against One-Day-Forward-Forecast')

plt.plot(p_stk[1000:],ls='-')

dates = p_stk.index[1000:]

plt.plot(dates,preds[900:],lw=0.5)

plt.legend(['real','pred_ar1'])

plt.savefig('ARIMA_OStest.png')

By the way, we plot the errors of real minus estimated, and the result is very similar with the shape of returns. The errors might have patterns of heteroscedasticity, and perhaps one way to improve is to introduce ARCH or GARCH.

errors = p_stk[100:] - pd.Series(preds,index=p_stk.index[100:])

plt.figure(dpi=200)

plt.title('Errors of ARMA OS test')

plt.plot(errors)

plt.savefig('errors_of_ARIMA_OStest.png')

Reference:

Quantitative Investment Using Python, written by Lirui CAI, a Chinese Book named《量化投资:以Python为工具》

The results only include estimation of price, and backtest results like Sharpe are not calculated.

Firstly, we are doing some data preprocessing. The data 'SH50 Price.csv' includes the price information of the 50 listed in Shanghai Stock Exchange, components of SSE50 index, from 2009 to 2013. Data is available here.

# Data Preprocessing

import math

import pandas as pd

import numpy as np

from matplotlib import pyplot as plt

import ffn

df = pd.read_csv('SH50 Price.csv')

df.Date = pd.to_datetime(df.Date)

stocks = df.columns[1:].tolist()

prices = df[stocks]

prices.index = df.Date

simret = ffn.to_returns(df[stocks])

simret.index = df.Date

p_stk = prices['Stk_600000'][1:]

r_stk = simret['Stk_600000'][1:]

After preprocessing, we obtain price series 'p_stk' and returns series 'r_stk'. Then, we are going to have a glance at the information provided in the datasets. We choose stk 600000 as our target to research and forecast.

# Part I: Print figures

plt.figure(dpi=200)

plt.plot(p_stk)

plt.title('Price of Stk 600000')

plt.savefig('Price of Stk 600000.png')

plt.figure(dpi=200)

plt.plot(r_stk)

plt.title('Returns of Stk 600000')

plt.savefig('Returns of Stk 600000.png')

The plots are:

Because ARIMA requires that the time series should be stationary and not white noise, in the following two parts, we are using ADF Unitroot Test and Ljung-Box White Noise Test to evaluate the characteristics of the price and returns series.

# Part II: Test Stationary: ADF unitroot test

from arch.unitroot import ADF

adf = ADF(p_stk)

print(adf.summary()) #p-value: 0.042

adf = ADF(r_stk)

print(adf.summary()) #p-value: 0.000

Both of them are stationary, while returns series are more stationary as it has significantly smaller p-value, even though the p-value of prices are lower than 5%.

# Part III: Test White Noise: Ljung-Box test

from statsmodels.tsa import stattools

LjungBox_p = stattools.q_stat(stattools.acf(p_stk)[1:12],len(p_stk))

LjungBox_r = stattools.q_stat(stattools.acf(r_stk)[1:12],len(r_stk))

>> LjungBox_p

(array([ 1186.72403401, 2347.64336586, 3480.90920079, 4585.93740601,

5664.13867134, 6714.87739681, 7742.00626975, 8745.83186807,

9727.36536476, 10686.98822401, 11624.15953127, 12540.96124026,

13436.9868527 , 14312.56022102, 15168.03444284, 16003.30196641,

16817.86975455, 17612.10904286, 18385.5534396 , 19138.93560575,

19870.54594297, 20580.38199531, 21268.22774876]),

array([ 4.68328128e-260, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000, 0.00000000e+000,

0.00000000e+000, 0.00000000e+000]))

>> LjungBox_r

(array([ 5.74442324e-05, 6.94963524e-01, 2.36008649e+00,

2.56248994e+00, 3.34789797e+00, 8.93787714e+00,

9.12876556e+00, 9.22065050e+00, 9.59020002e+00,

9.72752825e+00, 1.23203023e+01, 1.34820767e+01,

1.38328148e+01, 1.41616503e+01, 1.41655260e+01,

1.61315152e+01, 1.61315159e+01, 1.76274610e+01,

1.78485936e+01, 2.20053144e+01, 2.20102166e+01,

2.20334465e+01, 2.20547776e+01]),

array([ 0.99395273, 0.7064649 , 0.50110775, 0.63348204, 0.64651689,

0.17710208, 0.24354298, 0.32402559, 0.38466708, 0.46471465,

0.340055 , 0.3349957 , 0.38572255, 0.43773873, 0.51301413,

0.44382027, 0.51453146, 0.48043601, 0.5325723 , 0.34022234,

0.39892134, 0.45789384, 0.5169469 ]))

The null hypothesis is the series is white noise, and when the p-values (lower part of the result) of corresponding scores (upper part) are very small, we would reject the null hypothesis. In the prices, all values are highly significant, while the returns cannot reject the hypothesis (with 24 lags, the lowest one is even more then 10%).

Therefore, we accept that returns series are white noise, and we would only use price series in the following analysis.

# Part IV: Determine the order p and q in ARMA(p,q)

In part IV, we will use ARMA instead of ARIMA because we have already determined that order of I, d = 0 because returns are white noise. Next, we will determine the orders of ARMA(p,q).

Our first method to determine orders:

Draw ACF and PACF, and we found that ACF decays slowly while PACF suddenly drops, indicating an AR process only. We calculate its corresponding AIC and fit them with AR, setting maximum number of lags to be 12, and get the result that 1 is great. Check again with PACF plot, only lag 1 has significant coefficient. Therefore, we determine it to be AR(1) process.

axe1 = plt.subplot(211)

axe2 = plt.subplot(212)

plot1 = plot_acf(p_stk,lags=24,ax=axe1)

plot2 = plot_pacf(p_stk,lags=24,ax=axe2)

# Clear trend of AR only, with order for MA q = 0

# According to PACF, order p = 1

from statsmodels.tsa import ar_model

print(ar_model.AR(p_stk).select_order(maxlag=12,ic='aic')) # 1

Our alternative method to determine orders: Calculate the information criteria values of each order pairs.

order_determine = stattools.arma_order_select_ic(p_stk,ic=['bic','aic'])

>>order_determine

{'aic': 0 1 2

0 9463.164218 8000.817909 7042.006694

1 4518.521655 4520.130771 4520.321662

2 4520.100423 4520.516399 4521.249129

3 4520.254865 4521.373563 NaN

4 4520.303277 4520.282986 4517.939588,

'aic_min_order': (4, 2),

'bic': 0 1 2

0 9473.360970 8016.113036 7062.400197

1 4533.816782 4540.524274 4545.813540

2 4540.493925 4546.008277 4551.839383

3 4545.746743 4551.963817 NaN

4 4550.893531 4555.971616 4558.726593,

'bic_min_order': (1, 0)}

As BIC is more robust, the AIC of (1,0) is enarly the same with (4,2), and lower orders are better models to avoid overfitting risk, we choose ARMA(1,0), which leads to the same results with the above method.

# Part V: Fit prices with ARIMA(1,0,0) (Also ARMA(1,0) or AR(1))

# from statsmodels.tsa import ar_model

model = ar_model.AR(p_stk).fit(maxlag=12,method='cmle',ic='aic')

# arima_model package is a similar package, leading to a same result

from statsmodels.tsa import arima_model

model2 = arima_model.ARIMA(p_stk,order=(1,0,0)).fit()

Even though 'model' is the same with 'model2', the package ar_model has some bugs as I test it, and the package arima_model has attribute 'forecast' and it is more convenient to use this one. So, we only use model2 in the following parts.

>>model2.summary()

After ARMA modeling, we need to test whether the results of ARMA is white noise. If not, we may need more thorough researches. Fortunately, the results in the following shows that our result is white noise and no auto-correlation patterns.

# Part VI: Robustness Check: Test on Residuals

res = model2.resid

stdres = res/math.sqrt(model2.sigma2)

plt.figure(dpi=200)

ax1 = plt.subplot(211)

ax2 = plt.subplot(212)

ax1.set_title('standard residuals')

ax1.plot(stdres)

plot_acf(stdres,lags=24,ax=ax2)

plt.savefig('test_on_residuals_of_ARMA.png')

# Ljung-Box White Noise tests:

LjungBox_m = stattools.q_stat(stattools.acf(stdres[1:])[1:24],len(stdres[1:]))

# Residuals are White Noises

>>LjungBox_m

(array([ 0.27569431, 1.76892747, 3.40736876, 4.00228122,

4.30689222, 8.74894778, 8.75161177, 8.79754988,

8.84251288, 9.8780216 , 12.49860582, 13.03671273,

13.05266838, 13.31819495, 13.83520634, 16.51855888,

16.83245856, 18.33579538, 18.40466682, 23.02723339,

23.05146308, 23.051464 , 23.17217018]),

array([ 0.59953731, 0.41293556, 0.33297629, 0.40569721, 0.50612843,

0.18819711, 0.27098469, 0.35966135, 0.45193696, 0.45125936,

0.32735392, 0.3663779 , 0.44375169, 0.50163586, 0.53806246,

0.41739165, 0.46577191, 0.43374623, 0.49557738, 0.2874593 ,

0.34124064, 0.39882846, 0.45075531]))

To conclude, we cannot reject that results white noise, and the ARMA models can be used to forecast.

In the next part, we are going to give a forward forecast on the results, and plot corresponding confidence intervals.

# Part VII: Forecast

forecast = model2.forecast(steps=15)

plt.figure(dpi=200)

plt.grid(True)

plt.xticks(rotation=15)

plt.title('ARIMA(1,0,0) Forecast for Stk 600000')

plt.plot(p_stk[-30:])

dates = pd.DatetimeIndex(freq='d',start='2014-01-01',end='2014-01-15')

plt.plot(dates,forecast[0])

plt.plot(dates,forecast[2][:,0],ls=':')

plt.plot(dates,forecast[2][:,1],ls=':')

plt.legend(['real','pred','lc','uc'])

plt.savefig('ARIMA_forecast.png')

Finally, we perform out-of-sample test of ARIMA(1,0,0) by estimating one-day-forward price in each day of the sets with models built by the previous data. Continue the test every day beginning in the 100th index, and calculate the results. Because of limited space, we only provide a plot including the last 110 sets of predicted price against real price.

# Part VIII: Out-of-Sample Test for ARIMA(1,0,0) Performance

preds = []; lcs = []; ucs = []

for i in range(100,len(p_stk)):

model_o = arima_model.ARIMA(p_stk[:i],order=(1,0,0)).fit()

preds.append(model_o.forecast(1)[0][0])

lcs.append(model_o.forecast(1)[2][0][0])

ucs.append(model_o.forecast(1)[2][0][1])

plt.figure(dpi=200)

plt.grid(True)

plt.xticks(rotation=15)

plt.title('Real against One-Day-Forward-Forecast')

plt.plot(p_stk[1000:],ls='-')

dates = p_stk.index[1000:]

plt.plot(dates,preds[900:],lw=0.5)

plt.legend(['real','pred_ar1'])

plt.savefig('ARIMA_OStest.png')

By the way, we plot the errors of real minus estimated, and the result is very similar with the shape of returns. The errors might have patterns of heteroscedasticity, and perhaps one way to improve is to introduce ARCH or GARCH.

errors = p_stk[100:] - pd.Series(preds,index=p_stk.index[100:])

plt.figure(dpi=200)

plt.title('Errors of ARMA OS test')

plt.plot(errors)

plt.savefig('errors_of_ARIMA_OStest.png')

Reference:

Quantitative Investment Using Python, written by Lirui CAI, a Chinese Book named《量化投资:以Python为工具》

Tuesday, February 13, 2018

Feasible GLS (Generalized Least Squares)

GLS is applied when the residuals of OLS cannot satisfy two aspects of its classical assumptions: homoscedasticity and no auto-correlation, or rather,

rather than

There are many forms of FGLS, and the following passage describes its basic theorem and one form of FGLS that could eliminate if there is only heteroscedasticity:

Theorem of GLS, WLS, and One Form of FGLS

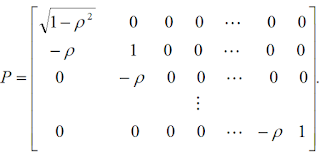

There is also another model to eliminate only AR(1) pattern in the OLS residuals:

1) Estimate coefficient $\rho$ in the residuals that

2) Transfer

to

by

and 3) Estimate corresponding with OLS estimation.

with OLS estimation.

I will add more forms of FGLS in the following if possible.

$E(uu^{'})=\sigma ^{2}\Omega $

$E(uu^{'})=\sigma ^{2}I$

There are many forms of FGLS, and the following passage describes its basic theorem and one form of FGLS that could eliminate if there is only heteroscedasticity:

Theorem of GLS, WLS, and One Form of FGLS

There is also another model to eliminate only AR(1) pattern in the OLS residuals:

1) Estimate coefficient $\rho$ in the residuals that

$e_{t} = \rho e_{t-1} + \varepsilon$

2) Transfer

$y = X\beta +u $

to

$Py = PX\beta +Pu $

by

and 3) Estimate corresponding

with OLS estimation.

with OLS estimation.I will add more forms of FGLS in the following if possible.

Subscribe to:

Comments (Atom)